Is a Credit Card or Personal Loan Better?

Considering the differences may help you pay off your debt faster, while paying less interest.

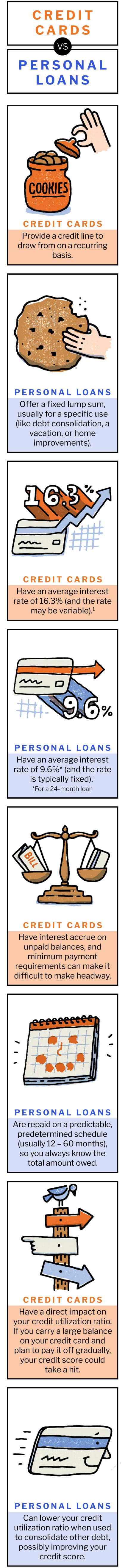

Whether you want to pay for your wedding or pay down debt, you may be considering using a credit card or taking out a personal loan. Although these solutions have some similarities — both are technically loans (not requiring collateral) and both tend to offer borrowers with good credit more favorable terms — there are also important differences.

Take a look at how credit cards and personal loans compare.

While credit cards are convenient for day-to-day purchases, personal loans may be a better long-term option for big expenses or paying down higher-interest debt. Consider your priorities and your financial situation to decide what works best for you.

Source

- Federal Reserve statistical release: Consumer Credit, May 2021,” July 8, 2021, Board of Governors of the Federal Reserve System

Ready to plan your next adventure?

See what the possibilities are with no obligation or impact to your credit score. Check your loan options now.

Recent Articles

-

How to Vacation Without Breaking the Bank

Read more -

Should I Pay off Debt or Save?

Read more -

Can I Use a Personal Loan for This? 6 Situations You May Be Considering

Read more -

4 Tips to Help Improve Your Credit Score

Read more -

How Can a Personal Loan Affect Your Credit Score?

Read more -

Things to Know Before You Apply for a Personal Loan

Read more

Customer Loan Support

Business Solutions Support

USA PATRIOT ACT NOTICE: IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

* Applications submitted on this website may be funded by one of several lenders, including: FinWise Bank, a Utah-chartered bank, Member FDIC; Coastal Community Bank, Member FDIC; Midland States Bank, Member FDIC; and LendingPoint, a licensed lender in certain states. Loan approval is not guaranteed. Actual loan offers and loan amounts, terms and annual percentage rates ("APR") may vary based upon LendingPoint's proprietary scoring and underwriting system's review of your credit, financial condition, other factors, and supporting documents or information you provide. Origination or other fees up to 10% may apply depending upon your state of residence. Upon final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. Loans are offered from $2,000 to $36,500, at rates ranging from 7.99% to 35.99% APR, with terms from 24 to 72 months. Minimum loan amounts apply in Georgia, $3,500; Colorado, $3,001; and Hawaii, $2,000. For a well-qualified customer, a requested loan of $10,000 serviced by LendingPoint over a period of 48 months that has an APR of 26.59% with an origination fee of 10% may have a payment of $340.52 per month. (Actual terms and rate depend on credit history, income, and other factors.) The total amount due under the loan terms provided is $16,345.12 and the disbursal amount is $10,000. In the example provided, the total financed amount is increased to receive the full requested loan amount after the origination fee is deducted. The total amount due is the total amount of the loan you will have paid after you have made all payments as scheduled.

* Applications submitted may be funded by one of several lenders including First Electronics Bank, a Utah-chartered bank, Member FDIC; Coastal Community Bank, Member FDIC; and LendingPoint, a licensed lender in certain states. Loan approval is not guaranteed. Minimum loan amounts apply in Georgia, $3,500; Colorado, $3,001; and Hawaii, $1,500. Upon final underwriting approval to fund a loan, said funds are often available the next non-holiday business day. Actual loan offers and loan amounts, terms and annual percentage rates (“APR”) may vary. Loans are offered from $500 to $10,000 (loan amount maximum based on MCC codes), at rates ranging from 7.99% to 35.99% APR, with terms from 24 to 48 months. For example, for a well-qualified customer, a $5,000 purchase will have a 90-day promotional period with no interest, a 3% fee, and $100 monthly payments. After the promotional period, a remaining balance will be a 24-month term loan, and $263.72 monthly payments with an overall APR of 26.54%.

**Minimum initial transaction of $1,000 in Alabama, Idaho and Iowa.

1. Alimony, child support, or separate maintenance income need not to be revealed if you do not wish to have it considered as a basis for repaying this obligation.

2. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning FinWise Bank is the FDIC Consumer Response Center, 1100 Walnut Street, Box #11, Kansas City, MO 64106. The federal agency that administers compliance with this law concerning Coastal Community Bank and Midland States Bank is the Federal Reserve Consumer Help Center, P.O. Box 1200, Minneapolis, MN 55480. The federal agency that administers compliance with this law for LendingPoint is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC 20580.

Click here to see our current list of state licenses

California residents click here ››

Wisconsin residents click here ››

Ohio residents click here ››

LendingPoint's NMLS #1424139 Visit NMLS Consumer Access